Investments

Market trend analysis, forecasts and profitability comparison. Investment opportunities in collecting.

Articles (209)

Страница 9 из 11

Exchanging Collectibles: How to Properly Document the Transaction

The issue of properly documenting an exchange of antiques and collectibles is directly related to security. In the antiques business, there are two key aspects of security: the personal safety of the collector and their family, and the protection of the collection itself from claims by law enforcement or criminal organizations.

Collector's GuideInvestments

Read More →

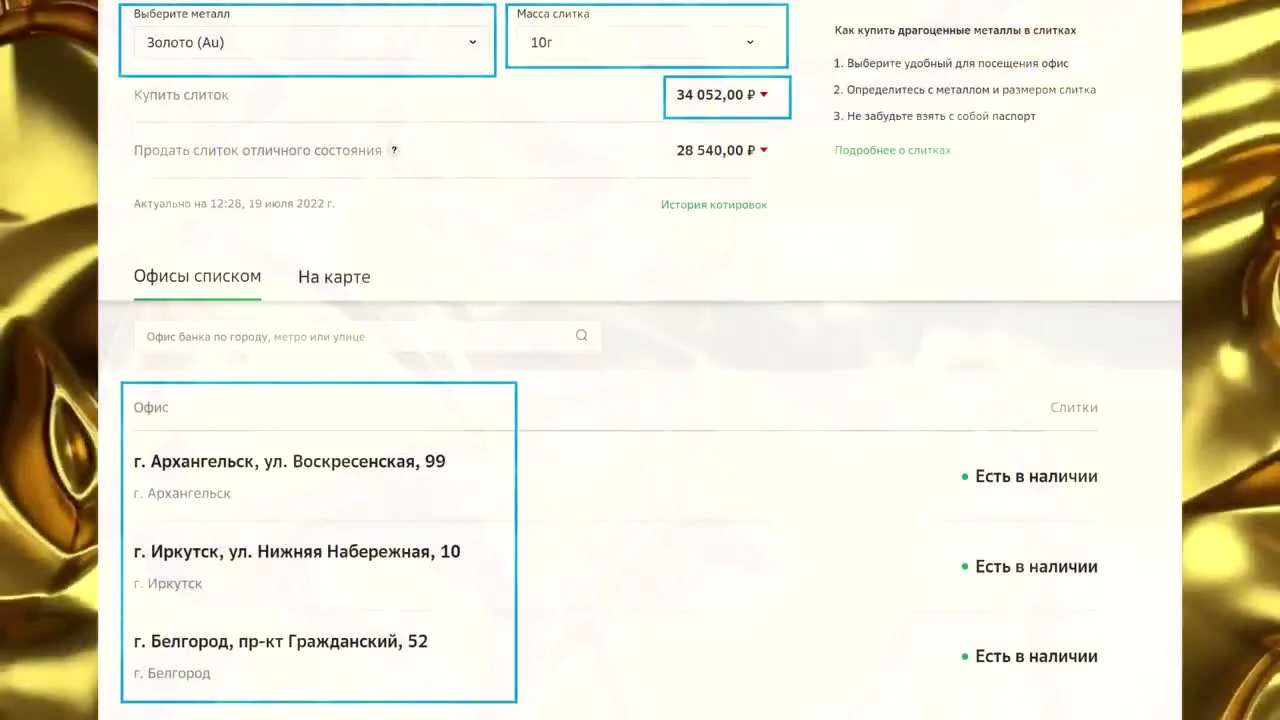

Gold Bars or Coins: What's More Profitable for an Investor in 2022?

After the abolition of VAT on precious metals in bars in March 2022 and the temporary abolition of income tax on their sale (for 2022-2023), investments in physical gold have become more attractive. An analysis of prices on July 15, 2022, shows that bars can be significantly more profitable than coins.

InvestmentsCollector's Guide

Read More →

A Guide to Buying and Storing Gold and Silver Bars

Investors in physical precious metals are often concerned about the proper packaging of bars when buying them from banks. This aspect became especially relevant after March 2022, when the abolition of VAT made bars at least 20% more profitable to acquire, which stimulated demand.

InvestmentsCollector's Guide

Read More →

Slabs for Investment Coins: What They Are and How Grading Works

For investors in gold and silver coins, it's important to understand what 'slabs' are and the grading process. Grading is the assessment of a coin's condition on a specific scale, which is one of the most important criteria determining its collectible value.

InvestmentsCollector's Guide

Read More →

Sovereigns: The History and Investment Value of the Most Recognizable Gold Coins

Gold British Sovereigns are among the most famous coins in the world. They have a long and rich history, having once had a significant impact on global monetary circulation. Thanks to their recognizability, these coins are found in the collections of both novice and experienced numismatists.

History of ThingsInvestments

Read More →

The Gold Standard of the Russian Empire: From Witte's Reform to World War I

From January 3, 1897, the Russian Empire, following most countries in the world except Mexico and China, introduced the gold standard, placing the ruble on a gold basis. Although gold coins had circulated in Russia before, they traditionally served more as a means of saving rather than payment.

History of ThingsInvestments

Read More →

Investing in Silver Coins: A Detailed Guide

Silver is an industrial metal with a wide range of applications. It is used in the chemical industry, electronics, battery production, the jewelry industry, as well as for making awards, mirrors, in medicine, and photography.

InvestmentsCollector's Guide

Read More →

All About Bullion Bars: From Purity to Purchase

A bar is a block of metal, in this case, a precious one. Bars can have different shapes and masses, and specialized refineries handle their production.

InvestmentsCollector's Guide

Read More →

New 'George the Victorious' Gold Bullion Coin Series

To properly understand the market, it is important to distinguish between bullion and collectible coins. Bullion coins have a number of characteristic features that determine their value primarily by the cost of the metal they contain.

InvestmentsCollector's Guide

Read More →

Investing in Coins: From the First Purchase to Organizing a Collection

A collector's story can begin with an accidental purchase. An example is the acquisition of a silver "Sable" coin, bought long ago for 390 rubles, even before it gained investment status. The coin was forgotten for a time but was later found, cleaned, and placed in a protective capsule.

InvestmentsCollector's Guide

Read More →

Gold Investment Coins: Answering Key Questions for Beginners

To begin, it's worth defining the concept of a savings or investment coin. This is a simple working definition that helps novice investors get their bearings.

InvestmentsCollector's Guide

Read More →

Preparing Coins for Sale: Creating an Inventory Spreadsheet

Before coins are listed for sale online, the final preparations must be completed. By this point, the seller should already have their starting assets established—the coin collection itself, ready for sale.

Collector's GuideInvestments

Read More →

Silver Coins: Pros, Cons, and Pitfalls for the Investor

The question of buying silver coins requires consideration of several key aspects. One of the main advantages of such assets is their liquidity. Silver coins can be quite easily sold to various organizations.

InvestmentsCollector's Guide

Read More →

US Gold Coins: History and Features

American gold coins are an integral part of the global precious metals market. Thanks to their rich history, high liquidity, and recognizability, they have always been a reliable component of any investment portfolio.

InvestmentsHistory of Things

Read More →

Investing in Antique Furniture: From a Personal Story to Practical Advice

An interest in antique furniture can begin in early childhood. For instance, a passion for carpentry started with conversations with a grandfather, Luft Philipp Philippovich, who was of German descent.

InvestmentsCollector's Guide

Read More →

All About Gold and Silver Investment Coins

An investment coin is a special type of coin issued by central banks. Their main purpose is for investment and creating a personal savings fund. Unlike regular money, their value is determined not by their face value, but by their precious metal content.

InvestmentsCollector's Guide

Read More →

Rules for Importing and Exporting Investment Coins Across the Border

The question of the rules for transporting silver and gold coins across the border often causes difficulties. For example, when crossing the border between Estonia and Russia, one might find that the prices for investment coins in Russia are significantly higher than in Europe. This is due to a shortage of popular coins, such as Australian or British ones, as their supply is limited.

InvestmentsCollector's Guide

Read More →

Collector or Investor: How to Approach Buying Coins

Many people who are passionate about coins ask themselves: are they numismatists, building a collection for pleasure, or investors, counting on future profits? Almost every collection owner has thought about its value and how it might change in a year, five, or ten years.

InvestmentsCollector's Guide

Read More →

Silverware Restoration: From Lost Luster to High Profitability

Tarnished silverware shouldn't be hidden away. You can restore its original mirror-like shine in just a few hours, and this process can become a source of good income without interfering with your daily routine.

InvestmentsCollector's Guide

Read More →

How to Start Collecting Coins Correctly: A Strategy for Beginners

Two collectors, strangers to each other, independently arrived at the same strategy for building their numismatic collections. One focused on coins of Tsarist Russia from the era of Nicholas II, collecting copper and gold specimens. The second chose coins from Imperial Germany and the Weimar Republic for his collection.

Collector's GuideInvestments

Read More →