Investments

Market trend analysis, forecasts and profitability comparison. Investment opportunities in collecting.

Articles (209)

Страница 8 из 11

How and Where to Sell Rare Coins: An Overview of the Main Methods

There are many ways and places where you can sell coins. They can all be broadly divided into two large groups: selling online and selling locally, i.e., offline.

Collector's GuideInvestments

Read More →

A Guide to Selling Coins: Where and How to Find Buyers

For beginner collectors and those who have accidentally found an old coin, questions often arise about where and how to sell it. Before putting a coin up for sale, it is necessary to at least roughly determine its value, which directly depends on two key factors: condition and rarity.

Collector's GuideInvestments

Read More →

How to Profitably and Safely Sell a Collectible Coin

Selling a coin, especially a valuable one, is a process that requires a systematic approach. To get the best price and ensure a safe transaction without losing money, it's important to follow a clear set of steps.

Collector's GuideInvestments

Read More →

Where to Profitably Buy and Sell Investment Coins

Investing in physical precious metals is an effective way to preserve your funds. This approach is accessible not only to wealthy individuals but also to those with a modest budget. Even with a small income, it is possible to build a significant collection over several years that will become a reliable financial asset.

InvestmentsCollector's Guide

Read More →

Investing in Silver: Which Coins to Buy Amid Rising Prices

Amid the continuing rise in silver prices, which are hitting new records, the question arises: what else can be profitably acquired? Although the metal has already appreciated significantly, there are reasons to believe it has not yet reached its peak value. Temporary pullbacks are possible, but the overall trend is likely to remain upward.

InvestmentsCollector's Guide

Read More →

How and Where to Buy Investment Coins in Russia: A Detailed Breakdown

Investing in precious metals often begins with purchasing popular coins, such as the silver 'George the Victorious.' This is one of the most well-known investment coins in Russia, possessing standard characteristics for its class.

InvestmentsCollector's Guide

Read More →

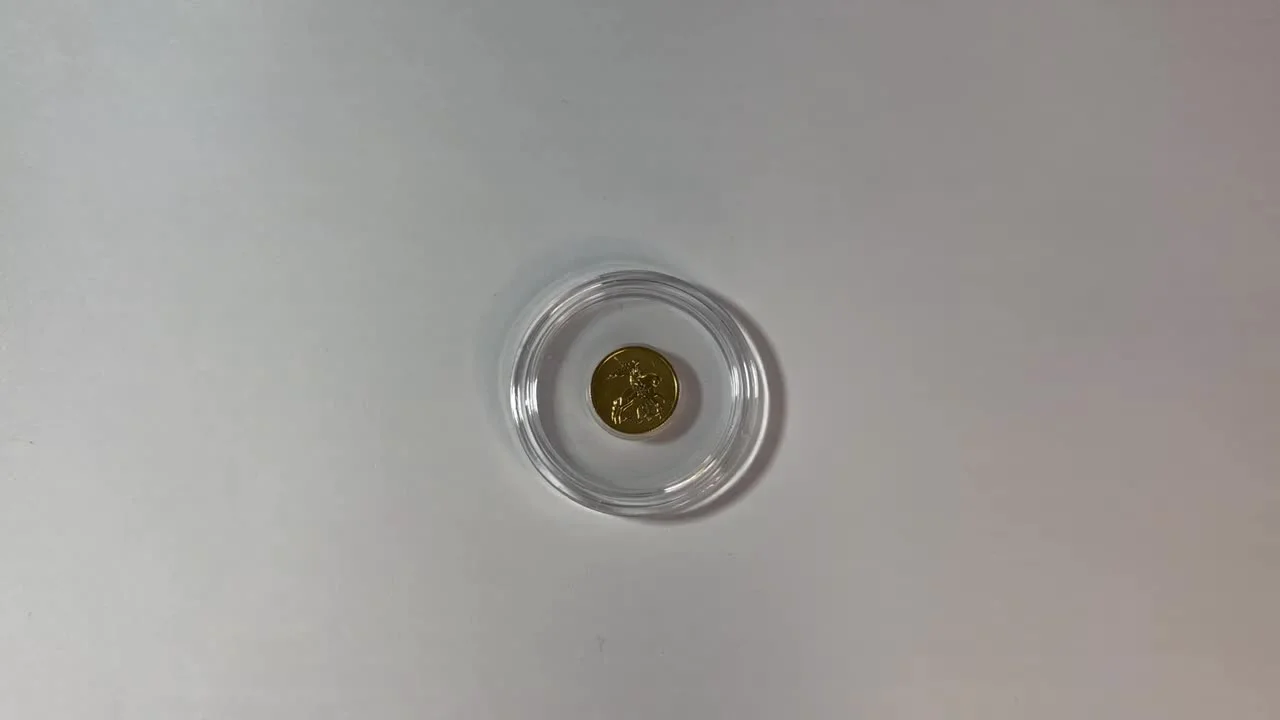

Investing in Gold: A Review of the 25 Ruble 'George the Victorious' Coin

One of the accessible options for investing in precious metals is the Russian Federation's 25 Ruble 'George the Victorious' gold bullion coin. This 2021 issue is considered the smallest gold bullion coin by weight in Russia.

InvestmentsCollector's Guide

Read More →

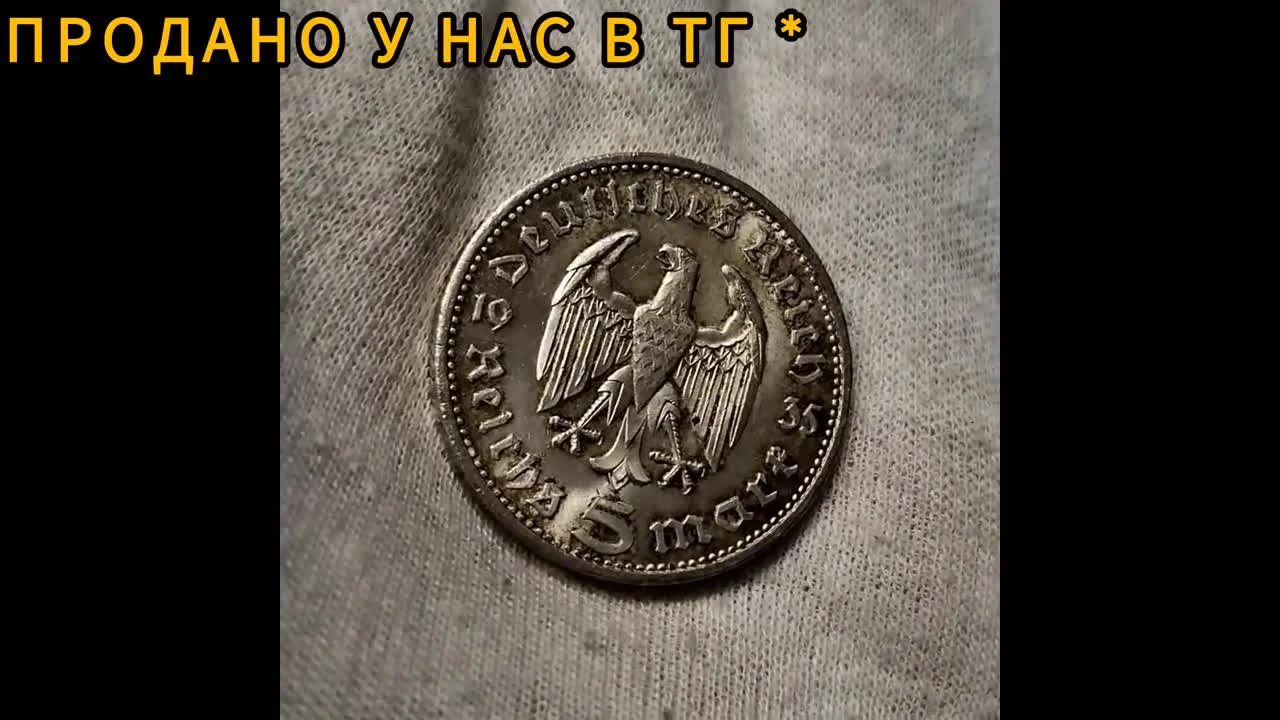

Antique Silver Coins of the German Empire: Prospects for the Collector

When working with a collection of antique silver coins, the need for sorting arises. It is important to determine which specimens will remain in a personal collection and which will be put up for sale. This process helps to systematize existing assets and formulate a future strategy.

InvestmentsCollector's Guide

Read More →

An Overview of Popular Silver Coins: From Pop Culture to Investment Classics

Silver tokens dedicated to the 'Harry Potter' universe have recently been gaining popularity. These items feature the crests of the Hogwarts school houses and are in demand among fans of the franchise. The quality of such tokens is generally high—they are neatly crafted and have a shiny surface.

InvestmentsCollector's Guide

Read More →

Investing in Silver Coins: Where to Buy, How to Pay, and What to Choose

When choosing investment coins, many collectors turn their attention to the products of the Australian Mint (Perth Mint). These coins stand out in the market due to several key advantages.

InvestmentsCollector's Guide

Read More →

German Silver Coins: How to Start a Collection

Many collectors with years of experience in numismatics, for instance, in collecting coins of Tsarist Russia or the Soviet Union, sooner or later turn their attention to other areas. Beautiful German coins can often be found in their albums.

Collector's GuideInvestments

Read More →

Where to Buy Collectible Coins: A Review of a Bank's Selection in Stuttgart

One day after work, I visited a bank in Stuttgart known for its coin sales department. This place is a point of attraction for collectors and precious metal investors.

Collector's GuideInvestments

Read More →

Four Key Ways to Acquire Gold

The simplest and fastest way to invest in precious metals is by opening an unallocated metal account, or UMA. This option is suitable for those who do not want to deal with the physical storage of gold. The process of buying virtual gold is extremely simple: through a banking app, you can transfer funds from your current account to a special 'gold' account and purchase the required amount of metal.

InvestmentsCollector's Guide

Read More →

A Review of Silver Bullion Coins: From Australia to the Caribbean

For novice collectors, the Australian Silver Koala coin can be an excellent option. Series with annually changing designs are particularly appealing, as they have good collecting potential. Unlike other popular coins, such as the American Eagle or the Britannia, Australian coins from the Perth Mint offer a number of advantages.

InvestmentsCollector's Guide

Read More →

Silver Coins of Kazakhstan: Overview and Features

Silver coins from Kazakhstan attract the attention of collectors and investors with their quality and design. They are described as beautiful, pleasant to the touch, and quite popular on the market. As a result, they have high liquidity, making them an attractive asset.

InvestmentsCollector's Guide

Read More →

An Investment Strategy for Silver Coins

Silver is an accessible and reliable tool for capital preservation. Unlike collectible coins, whose value is often determined by rarity and condition, bullion coins are valued primarily for their precious metal content.

InvestmentsCollector's Guide

Read More →

Liquidity of Investment Coins: Which Specimens Are Easy to Sell

Coin liquidity is the ability to quickly sell them at a good, market-appropriate price. There is always demand for such coins. A paradox exists: the more expensive and rarer a coin is, the harder it is to find a buyer willing to pay the asking price.

InvestmentsCollector's Guide

Read More →

The History of the Gold Chervonets: From Ivan III to the Soviet 'Sower'

Chervonets is the traditional Russian name for large gold coins, both domestic and foreign. The name comes from the word 'chervonny,' which means red or crimson. The ancient minting technology involved using an alloy of gold and copper, which gave the coins a reddish hue.

History of ThingsInvestments

Read More →A Guide for the Beginner Antiques Investor

In unstable times, many look for ways to preserve their savings. The question arises: what to invest in to not only avoid losing money but also potentially turn a profit? People often seek 100% guarantees, but in the world of investments, especially in antiques, they don't exist. For a novice making a random purchase without deep knowledge, the probability of success is close to zero.

InvestmentsCollector's Guide

Read More →A Guide for the Novice Antique Dealer: How to Start a Business from Scratch

Many people, especially those on a limited budget, are interested in how to start an antique business. It's important to understand from the outset that making money quickly and easily in this field isn't possible. This is a business where income comes from knowledge and intellectual effort, not blind luck.

Collector's GuideInvestments

Read More →