Investments

Market trend analysis, forecasts and profitability comparison. Investment opportunities in collecting.

Articles (209)

Страница 7 из 11

Euparkeria: South African Silver Investment Coin from the 'Age of Dinosaurs' Series

This review focuses on a one-ounce silver coin produced by the South African Mint Company. This piece is the eightieth ounce of silver added to a private collection this year. The coin comes in its original factory packaging, which is a cardboard blister pack with a detailed description and specifications.

InvestmentsCollector's Guide

Read More →

Silver Price Hits Record High: An Analysis of Key Growth Factors

The price of silver has shown a significant surge, reaching $38.67 per ounce. This figure is one of the highest in the last decade, attracting increased attention from both investors and collectors.

InvestmentsCollector's Guide

Read More →

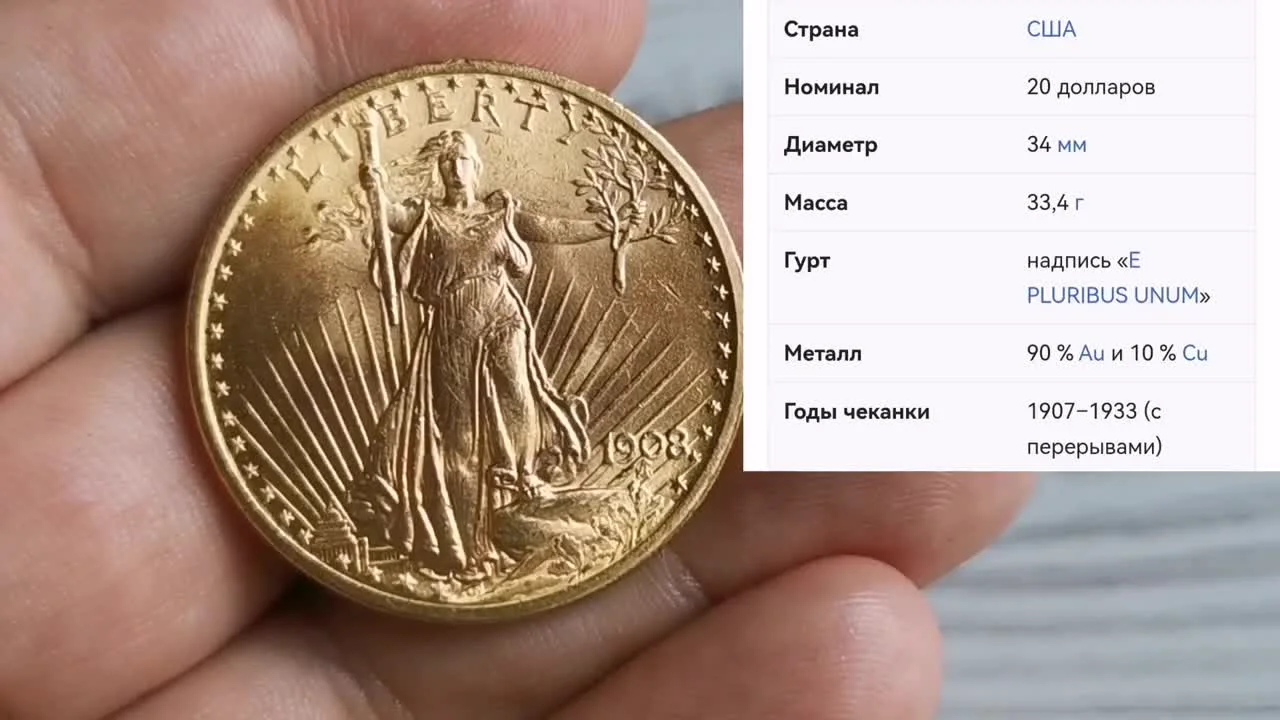

The Rare 1908 $20 Coin: History of the 'Godless' Coin

The $20 gold coin, known as the 'Saint-Gaudens Double Eagle,' is one of the most iconic in American numismatics. Its design was created by the renowned American sculptor and medalist Augustus Saint-Gaudens. These coins were minted from 1907 to 1933, becoming a true work of art.

History of ThingsInvestments

Read More →

The Hidden Potential of Silver: Investments, Risks, and Future

Silver has long attracted the attention of investors as a potentially undervalued asset. Experience dating back to 2008 shows interesting dynamics when comparing different asset classes. Specifically, a portfolio consisting of a basket of metals has demonstrated significantly better results compared to a portfolio of a basket of currencies.

InvestmentsCollector's Guide

Read More →

Review of New 2025-2026 Investment Coins

The 2025 Australian 'Emu' silver coin is presented. This specimen has been certified by the grading company NGC and received the highest preservation grade of MS 70. The slab also features the 'First Day of Issue' designation.

Investments

Read More →

The Mints of Australia and Their Famous Products

The minting of Australian coins is concentrated at two key facilities. These are the Royal Australian Mint, which is primarily responsible for issuing coins for domestic circulation, and the Perth Mint, which is a world leader in the production of investment coins made from precious metals.

Collector's GuideInvestments

Read More →

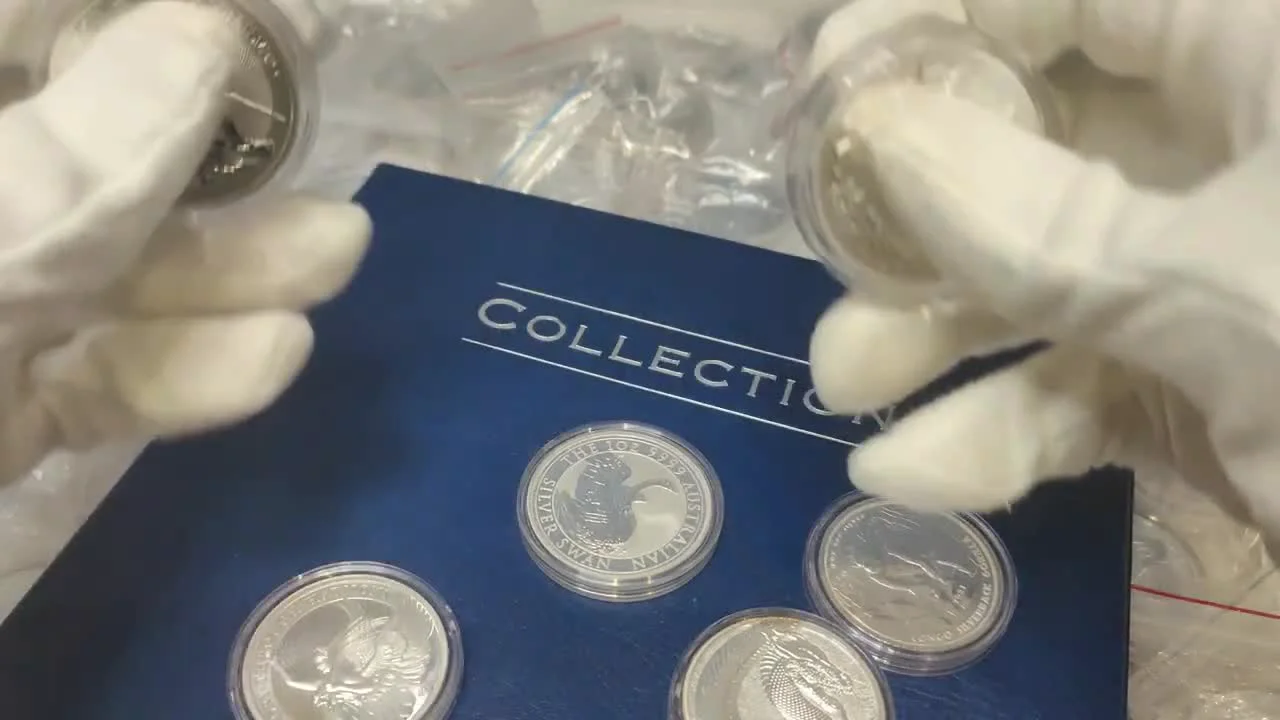

Australian Investment Coins: A Guide for the Beginner Collector

The question of which investment coins to buy has no single answer, as the choice is deeply personal. Every collector has their own preferences, goals, and financial capabilities. Therefore, giving universal advice would be incorrect.

InvestmentsCollector's Guide

Read More →

Australian Lunar 2024: Review and Investment Potential of the 'Year of the Dragon' Coin

A new addition has appeared on the numismatic market—the Australian Lunar, dedicated to the symbol of 2024, the Chinese dragon. These coins, made of gold and silver, have already begun to reach the first buyers and collectors.

InvestmentsCollector's Guide

Read More →

Numismatics for Beginners: How to Start Collecting Coins

Numismatics is not only the collection of coins but also an auxiliary historical discipline. It studies the history of minting and monetary circulation, revealing important aspects of the past.

Collector's GuideInvestments

Read More →

The Gold "Double Eagle": History and Value of the Most Popular U.S. Coin

Among the many American gold coins, both modern and old, one stands out for its popularity and beauty. This is the coin known as the "Double Eagle." It is rightfully considered one of the most beautiful and sought-after near-one-ounce gold coins in the world.

History of ThingsInvestments

Read More →

Ducats — The Main Gold Coins of Europe

Ducats can, without exaggeration, be called the main gold coin of Europe. For 700 years, they were part of the continent's monetary circulation, becoming the result of a centuries-long international consensus among European states. During this time, many thousands of varieties of these coins appeared.

History of ThingsInvestments

Read More →

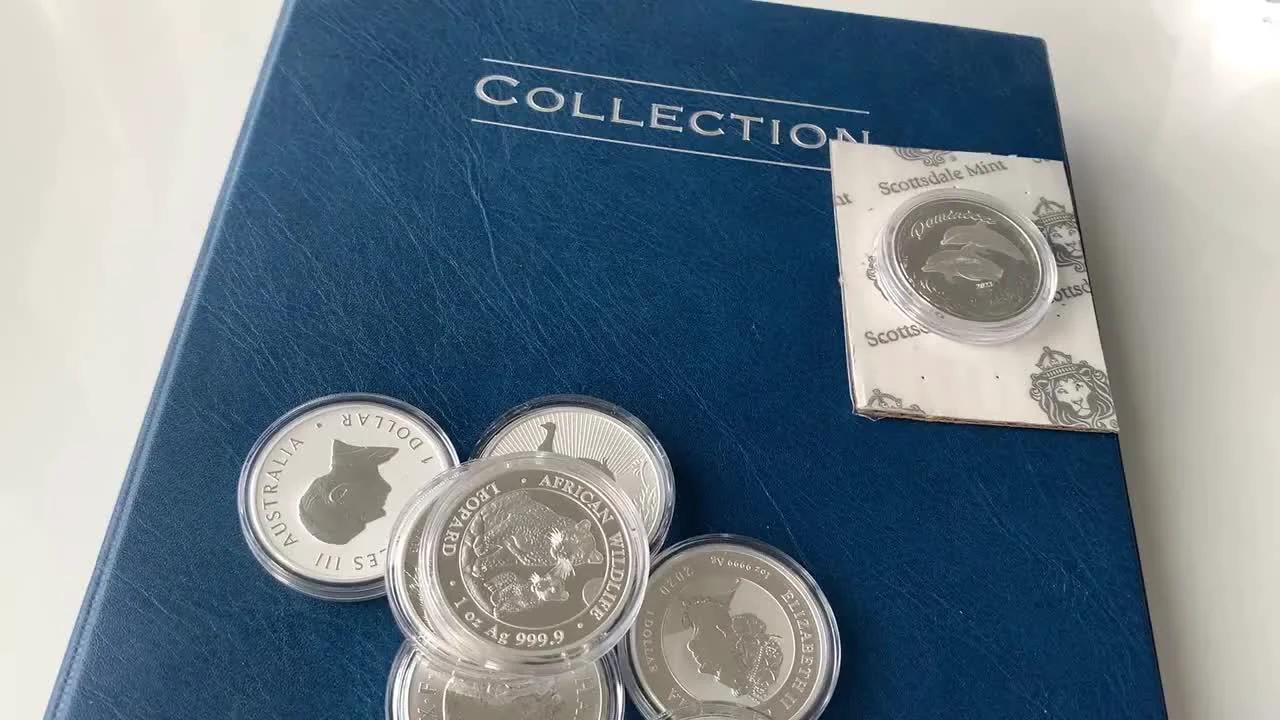

Overview of Modern Investment Coins: From Australia to Germany

Australian investment coins hold leading positions in the market due to their high quality, reliability, and predictability. They have high liquidity, which makes them sought-after among collectors. Series dedicated to the continent's unique fauna are especially popular.

InvestmentsCollector's Guide

Read More →

Soviet Jewelry: An Investment in Nostalgia or Just Scrap Metal?

The question of the value of Soviet jewelry evokes diametrically opposed opinions. Some consider it tasteless, mass-produced work with no artistic or investment interest. In their view, such pieces are not worthy of attention.

InvestmentsHistory of Things

Read More →

Review of New Silver Coins: From the Panda to the Archangel Michael

Among the new arrivals, the 2025 oval silver 'Panda' coin stands out. This 30-gram, .999 fine silver specimen with a face value of 10 yuan is in high demand, despite its huge mintage.

InvestmentsCollector's Guide

Read More →

An Overview of New Silver Investment Coins

The new shipment included interesting pieces from various producers. One of the first was an oval silver coin from Scottsdale Mint, dedicated to Dominica, featuring dolphins, dated 2023.

InvestmentsCollector's Guide

Read More →

Investing in Gold and Silver: An Honest Forecast and Strategy

When discussing the future of precious metal coins, whether silver or gold, the honest forecast is this: no one knows the future. It is impossible to predict with 100% certainty how any given asset will perform in the market.

InvestmentsCollector's Guide

Read More →

Soviet Jewelry: An Investment in Nostalgia or Tasteless Mass Production?

The question of the value of Soviet jewelry evokes diametrically opposed opinions. Some consider these pieces to be tasteless mass-produced items with no artistic or investment appeal. In their view, such jewelry is not worthy of attention.

InvestmentsHistory of Things

Read More →

Top 5 Best Silver Bullion Coins

When choosing coins for precious metal investments, it's best to focus on examples that meet several important criteria. First and foremost, these are coins whose value is as close as possible to the price of the metal they contain. These are known as pure bullion coins.

InvestmentsCollector's Guide

Read More →

Investing in Soviet Jewelry: Myths and Realities

The question of the investment appeal of Soviet jewelry evokes diametrically opposed opinions. On one hand, there is a belief that it is nothing more than mass-produced stamping, holding neither artistic nor investment interest.

InvestmentsCollector's Guide

Read More →

Real Prices of Gold Coins at European Buyers

When assessing the value of gold coins at buyers in the European Union, particularly in Riga, it's important to understand that we are talking about so-called 'raw' or common-circulation coins. These are coins that are not in special protective capsules (slabs) and do not have high collectible value.

InvestmentsCollector's Guide

Read More →