Investments

Market trend analysis, forecasts and profitability comparison. Investment opportunities in collecting.

Articles (209)

Страница 6 из 11

What Are Art Indexes and How They Help Investors

Investing in art has traditionally been considered a field where intuition, taste, and deep knowledge of a specific artist or movement play a major role. However, the modern art market is becoming more transparent and accessible to a wider range of investors who prefer to rely not only on subjective opinion but also on objective data.

Investments

Read More →

How Do Global Crises Affect the Antiques Market?

During periods of global crises, when traditional financial markets like stocks and bonds experience high volatility, investors begin to seek alternative ways to preserve capital. Historically, one such avenue is investing in antiques and art objects. These tangible assets often behave differently from financial instruments, serving as a safe-haven asset.

Investments

Read More →

The Investment Potential of Vintage Watches: A Market Analysis

In the world of alternative investments, vintage watches hold a special place, demonstrating impressive growth dynamics. Some models from legendary manufacturers like Patek Philippe and Rolex show returns that outperform even traditional safe-haven assets, including gold. This transforms watch collecting from a hobby into a well-thought-out financial strategy.

Investments

Read More →

Rare Books as an Investment: What to Look for When Buying?

Bibliophilia can become more than just a hobby; it can be a real business if you understand which characteristics give a book investment value. Not every old book is rare and expensive. Its value is formed by a combination of unique traits that make a specific copy desirable for collectors.

Investments

Read More →

Investing in Numismatics: Which Coins Will Appreciate in Value?

When starting to invest in coins, it's important to understand the key difference between the two main categories: investment (bullion) and collectible coins. These are two completely different approaches to investing, with different pricing logic and growth potential.

Investments

Read More →

Art as an Asset: Why Investing in Paintings Remains Relevant

In the world of finance, subject to constant fluctuations, investors seek stable assets to protect their capital. Art, particularly painting, has long earned a reputation as a 'safe haven.' Unlike stocks or currencies, whose value can change dramatically under the influence of geopolitical and economic news, the value of artworks is more inert.

Investments

Read More →

Top 5 Collectibles for Profitable Investments in 2025

Investing in collectibles is not just about buying beautiful things, but a strategic capital investment in assets with growth potential. Before you start, it's important to understand the basic concepts that will help you make informed decisions and navigate the market. Understanding these terms is the foundation for success in this field.

Investments

Read More →

Правила хранения и ухода: как защитить свою коллекцию от времени?

Любая коллекция, будь то собрание редких марок, антикварной мебели или произведений искусства, является не только предметом гордости, но и активом. Ценность этого актива напрямую зависит от его физического состояния. Предмет в идеальном, или, как говорят коллекционеры, «мятном» состоянии, может стоить в десятки раз дороже своего аналога с потертостями, выцветшими красками или следами коррозии. Время неумолимо, и естественные процессы старения материалов неизбежны, однако задача коллекционера — максимально замедлить их.

Collector's GuideInvestments

Read More →

Гид по налогам для коллекционера: всё о НДФЛ, вычетах и таможенных сборах

Коллекционирование для многих начинается как увлекательное хобби, но со временем может перерасти в серьезную финансовую деятельность. Любая продажа предмета из коллекции с получением дохода потенциально создает налоговые обязательства перед государством. Важно понимать разницу между разовой продажей ненужного предмета и систематической деятельностью, направленной на извлечение прибыли. Если коллекционер регулярно покупает и продает предметы, это может быть расценено налоговыми органами как предпринимательская деятельность, что влечет за собой необходимость регистрации в качестве ИП или самозанятого и уплату соответствующих налогов.

Collector's GuideInvestments

Read More →

Как выбрать свою нишу в коллекционировании: от монет до современного искусства

Коллекционирование — это больше, чем простое накопление предметов. В его основе лежат глубокие психологические мотивы. Для одних это способ сохранить историю, прикоснуться к прошлому через материальные артефакты. Старинная монета или открытка становятся мостом, соединяющим нас с другой эпохой. Для других коллекционирование — это страсть к систематизации и упорядочиванию, стремление создать идеальный, завершенный набор, будь то все марки определенной серии или все первые издания любимого автора.

Collector's GuideInvestments

Read More →

The History of the Imperial Fabergé Eggs

The tradition of giving precious Fabergé eggs for Easter originated with Emperor Alexander III. In 1885, the fifth year of his reign, he decided to give an unusual gift to his wife, Empress Maria Feodorovna, who was a Danish princess born in Copenhagen.

History of ThingsInvestments

Read More →

Art as an Asset: Why Investing in Paintings Remains Relevant

In the world of finance, dominated by stocks, bonds, and real estate, art holds a special place as an alternative asset class. Its key distinction lies in its tangible nature and low correlation with traditional markets. When stock exchanges experience a downturn, the value of artworks often follows its own trajectory, determined by unique factors such as rarity, provenance, and cultural significance. This makes painting an attractive tool for diversifying an investment portfolio.

InvestmentsCollector's Guide

Read More →

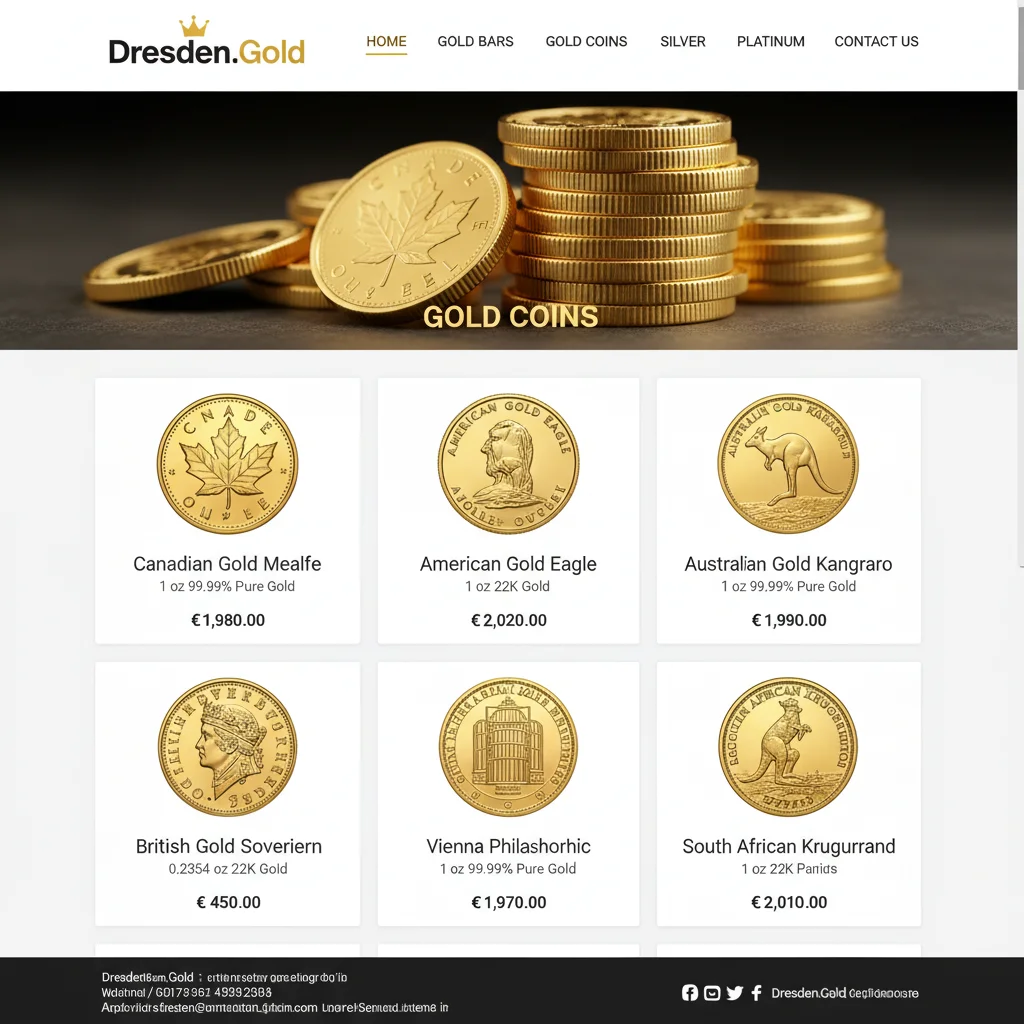

A Complete Guide to Buying Gold Investment Coins in 2024-2025

The first and most important question when buying gold coins is choosing where to purchase them. In Russia, the price directly depends on this, and the difference can be very significant. There are three main options: coin dealers, banks, and buying from private individuals.

InvestmentsCollector's Guide

Read More →

The 15 Ruble Gold Coin of 1897: History and Value of Nicholas II's 'Imperial'

The 15 ruble gold coin of 1897 appeared during the reign of Emperor Nicholas II. Its issuance was a direct consequence of the monetary reform carried out by Sergei Yulyevich Witte in 1895–1897. The main goal of the reform was to introduce gold monometallism in Russia, modeled after Great Britain, to strengthen the financial system.

History of ThingsInvestments

Read More →

A Personal Experience of Buying Gold Coins in Dresden

Investing in physical gold often involves choosing a purchasing method. Ordering online carries certain risks, while buying from large dealers can include overpayments and shipping costs. An alternative is to purchase coins in person, for example, from specialized companies in Europe.

InvestmentsCollector's Guide

Read More →

Why Collectors Sell Coins: Three Main Reasons

For many numismatists and investors, selling coins is a natural and logical step, initially incorporated into their strategy. Coins are acquired not only for aesthetic pleasure but also as an asset whose value increases over time. This is especially true for gold coins, which see sharp price increases over time.

InvestmentsCollector's Guide

Read More →

Investing in Gold: A Review of Britannia Bars and Coins from the Royal Mint

In the current economic climate, many are once again turning to precious metals as a reliable way to invest and preserve wealth. This is due to several factors relevant to both regions with military tensions and countries experiencing high inflation.

InvestmentsCollector's Guide

Read More →

Canadian Gold Rush: History and Investment in Coins

There is a series of Canadian coins dedicated to one of the most iconic events in the history of gold mining—the Klondike Gold Rush. The series already includes three releases, the latest of which is dated 2023.

InvestmentsCollector's Guide

Read More →

Precious Metals Market: Why Prices Are Rising and Which Asset Is Undervalued

Amid global uncertainty and geopolitical tensions, precious metals are becoming increasingly attractive to investors. In 2025, the market is showing record-breaking performance, with gold's rise to all-time highs drawing particular attention.

Investments

Read More →

The Gold Centenario: History and Characteristics of the Mexican 50 Peso Coin

The 1947 Mexican 50 peso coin holds a special place among the world's gold coins. In numismatic circles, it is better known as the 'Centenario.' This coin attracts attention not only for its weight but also for its rich history.

InvestmentsHistory of Things

Read More →