Investments

Market trend analysis, forecasts and profitability comparison. Investment opportunities in collecting.

Articles (209)

Страница 5 из 11

Collectible Gold Coins of the USSR: Alternatives to the 'Chervonets-Sower'

Recently, there has been a significant increase in gold prices, which has sparked heightened interest in investment and collectible coins. One of the most popular coins in this context has become the gold 'Chervonets-Sower'. Many novice investors and collectors, after acquiring a few of these coins, wonder: what other gold coins from the Soviet period might be interesting for investment?

InvestmentsCollector's Guide

Read More →

Selling Your Gold: A Comprehensive Step-by-Step Guide

A crucial understanding of how to safely sell gold is often overlooked in the broader context of investing in precious metals. While the initial focus is undeniably on accumulation, it is equally vital for investors to comprehend what to anticipate when the time comes to divest their holdings. The Gold Reserve Blog

Investments

Read More →

Authenticating Investment Coins: Hallmarks of Authenticity

An Expert Guide to Identifying and Authenticating Investment Coins: Examining Key Parameters, Authentication Methods, and Distinguishing Forgeries for Collectors.

Investments

Read More →

Investment Prospects in USSR Silver Poltinniks: An Analysis of Prices and Rarity

Investing in silver through numismatics offers interesting prospects, and Soviet poltinniks from the 1920s are a promising area. To assess their potential, it's worth considering coins issued from 1921 to 1927. Collecting these coins, starting, for example, at the end of August 2025, can show certain results within just 3.5 months.

InvestmentsCollector's Guide

Read More →

The Economics of Contemporary Art: Branding, Scarcity, and the Paradoxes of Price

The world of contemporary art operates under its own unique economic laws, where traditional concepts of value and scarcity are redefined. Here, the key role is played not only by the artistic merit of the works but also by factors such as branding, rarity, and the influence of the so-called 'gatekeepers' of the art market.

InvestmentsCollector's Guide

Read More →

Artist's Choice: A New Model of Collaboration Between Auctions and Galleries

A new initiative called 'Artist's Choice' has emerged, designed as an innovative path for artists and their galleries. The main goal of this project is to provide them with the opportunity to bring works directly to the market through an auction platform.

Auction NewsInvestments

Read More →

Artist's Choice: A New Transparent Model for Selling Contemporary Art at Auction

A new sales format, titled 'Artist's Choice', is set to launch in September in New York. This initiative will debut in conjunction with the season-opening contemporary curated auction, creating a novel pathway for contemporary artists and their galleries to engage with the auction market.

Auction NewsInvestments

Read More →

Silver: Arguments For and Against Further Price Growth

After a long period of stagnation, when many investors were hesitant to buy silver even at $30 per ounce, it has recently seen dynamic growth. In just a few months, the price surpassed the $40 mark and then surged higher, crossing the $50 and $55 thresholds and approaching the $60 per ounce level.

Investments

Read More →

The Purchasing Power of the Tsarist Ruble: Myths and Reality

One of the common myths is the idea of the extremely high purchasing power of the pre-revolutionary ruble. This myth, actively promoted since the late 1980s, is based on recalculating the ruble's value through its gold content.

History of ThingsInvestments

Read More →

The Silver Market on the Verge of Change: A Bubble or a New Reality?

Recently, the situation in the silver market has been developing dramatically. Prices are showing explosive growth, sparking active debates among investors and analysts. Many are wondering: is this another financial bubble?

Investments

Read More →

Prospects for Gold and Silver in 2026: Analysis and Forecasts

To analyze the prospects for gold and silver in 2026, it is necessary to review the results of the outgoing year, 2025. As of December 26, 2025, precious metal prices have reached significant levels, creating a basis for further forecasts.

Investments

Read More →

Investing in Silver Coins: A Review of New Releases and a Price Forecast for 2026

New and interesting series are emerging in the world of numismatics. For example, Rwanda has launched the 'Sporting Ounce' series, with its first coin dedicated to cyclists and dated 2025. This initiative is attracting the attention of collectors who will be watching the series' development.

InvestmentsCollector's Guide

Read More →

Tax Planning for Antiques Investors: How to Optimize Payments

For a serious investor, owning a valuable collection of antiques is not just a hobby, but the management of a significant asset. Direct personal ownership is the simplest method, but often not the most effective from a tax and management perspective.

Investments

Read More →

Comparative Analysis: Returns on Antiques vs. Stocks and Real Estate

When building an investment portfolio, many limit themselves to traditional instruments like stocks and bonds. However, the world of finance offers other ways to preserve and grow capital, including investments in real estate, gold, and art. These assets fall into the category of alternative investments and have their own unique characteristics.

Investments

Read More →

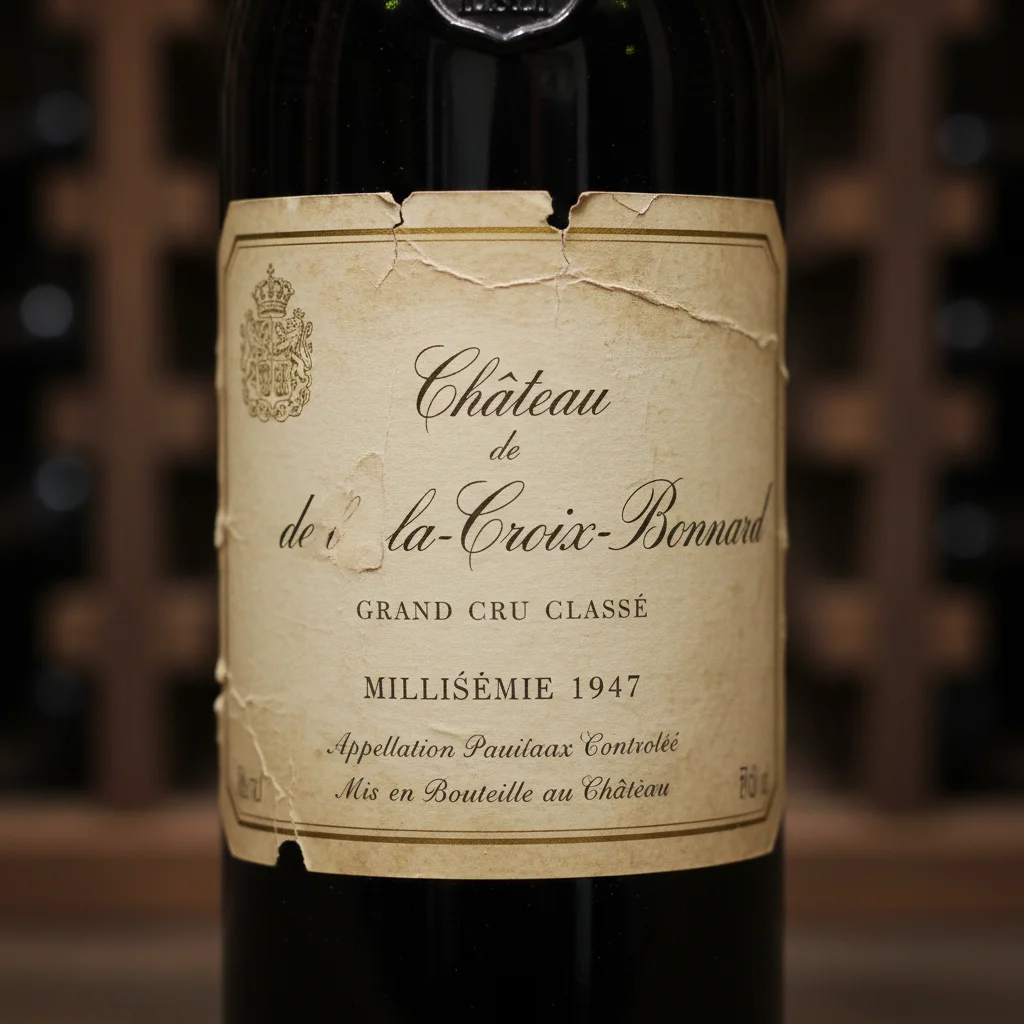

Wine Investment: How and Why to Collect Rare Wines

Wine investment is the allocation of funds into rare and collectible wines with the aim of reselling them later at a higher price. This type of alternative investment is attractive due to its stability and low correlation with traditional stock markets, especially during periods of economic instability.

Investments

Read More →

Art Market Forecasts: What Collectors Can Expect in the Coming Years

In recent years, there has been a steady shift in the art market's center of activity towards Asia. Hong Kong, Shanghai, and Singapore are strengthening their positions as leading global hubs, competing with New York and London. This growth is driven by the emergence of a new generation of wealthy collectors from China, South Korea, and other countries in the region, who are actively investing in both national and Western art.

Investments

Read More →

How to Assess the Investment Appeal of an Object: A Step-by-Step Guide

Investing in tangible assets, whether it's antiques, art, or collectibles, requires not only taste but also cold calculation. Investment appeal is a comprehensive indicator that determines how profitable an investment in a specific item is in terms of its future value growth. Without careful analysis, you risk acquiring an item that will please the eye but never yield a financial return.

Investments

Read More →

The 'Blue Chips' of the Art Market: Which Artists' Works Always Hold Their Value?

The term 'blue chips,' originating from the stock market, has also found its application in the art world. It refers to artists whose names have become global brands and their works — coveted objects for collectors and investors. These are masters whose art has stood the test of time and whose reputation is unshakeable.

Investments

Read More →

NFT and Digital Art: A New Frontier for Collector-Investors

At the core of the 'crypto-art' phenomenon lies the technology of non-fungible tokens, or NFTs. Unlike cryptocurrencies like Bitcoin, where each coin is identical to another, each NFT is unique and exists as a single copy. This uniqueness is recorded on the blockchain—a decentralized digital database—which guarantees the authenticity and ownership history of the asset.

Investments

Read More →

Portfolio Diversification: How Collectibles Reduce Risks

A traditional investment portfolio typically consists of stocks and bonds. However, during periods of economic instability, these assets can lose value simultaneously. To protect capital, investors are increasingly turning to alternative investments—assets not directly correlated with the stock market.

Investments

Read More →