Gold Coins: A Guide to Global Trends and the Realities of Investing in Russia

Learn about the gold coins favored by investors globally and in Russia, understand how the IRA system operates, and uncover why the Australian Kangaroo stands out as a premier investment choice.

Mysteries of Investment Gold: Western and Russian Preferences

Investors in the West and Russia demonstrate completely different approaches to selecting gold coins for preserving their funds. This difference shapes unique trends in the global investment coin market.

According to Dmitry Kalinichenko, director of the Cypriot investment company «KDG GOLD&SILVER», the presence of a coin in IRA lists plays a key role in determining its demand and liquidity. This factor significantly influences the preferences of Western investors.

What is an Individual Retirement Account (IRA)?

An IRA, or Individual Retirement Account, is a system created by the American pension system. It allows retirement contributions to be stored in a variety of instruments.

In addition to traditional securities and shares, this system allows investment in gold investment coins. By the time of retirement, the system participant possesses a certain quantity of gold ounces.

It is important to note that IRA clients cannot receive their savings physically. However, the value of their assets increases as the price of the precious metal rises. The selection of coins is made by the retired client from a special IRA list.

| Parameter | Description |

| Name | Individual Retirement Account |

| System | American Pension |

| Purpose | Storage of Retirement Contributions |

| Instruments | Securities, Shares, Gold Investment Coins |

| Receipt of Funds | Cannot Be Received Physically |

| Value | Increases with the Price of Precious Metal |

Currently, the IRA serves as a global benchmark for investors, representing a list of the most liquid and popular investment coins.

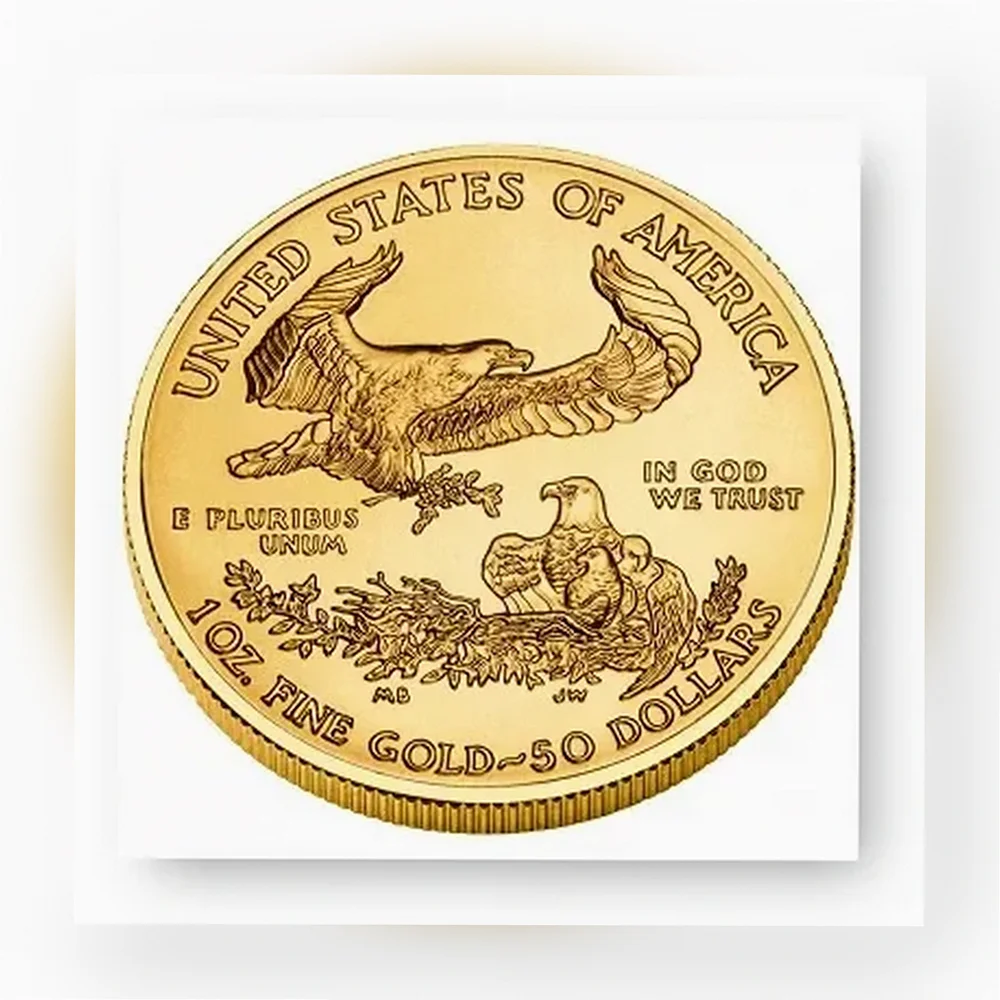

- American Gold Eagle

- American Gold Buffalo (uncirculated)

- Australian Kangaroo

- Austrian Philharmonic

- Gold Britannia

- Canadian Maple Leaf

- And others

Gold Krugerrand: An Investment Symbol Beyond the Listings

Interesting fact: The gold Krugerrand, a coin produced in South Africa that enjoys immense popularity worldwide, was not included in the IRA list.

This is because the Krugerrand has no face value, essentially making it a bullion coin. US monetary policy does not allow it to be included in IRA lists, as it is recognized as physical gold by weight, rather than a 'world currency'.

Nevertheless, for investors worldwide, the Krugerrand has become the de facto benchmark for investment coins. These gold coins celebrated their fiftieth anniversary last year, and for most of that time, they have held leading positions in popularity rankings.

Features of the Russian Market for Gold Investment Coins

The investment coin market in our country is relatively young, and its development shows a catching-up trend. This is a natural stage which, as the experience of other markets (e.g., electronics or automobiles) shows, will lead to stabilization and gradual integration into global standards.

The preferences of Russian investors have been significantly influenced by frequent cases of deception in the past. Back then, a 917 fine gold coin was valued less than a 925 fine coin, even with an equal mass of pure metal.

As a result, 22-karat gold coins are undeservedly in low demand on the Russian market. Meanwhile, in the West, no such prejudices exist.

For example, the 22-karat gold English Sovereign is one of the most popular coins. It has been in circulation for over three centuries, minted both in Great Britain and all its colonies.

Exotic Investments: Beauty and Risk

Among the so-called exotic investment coins, the "Mexican Peso" and the "African Elephant" (Somalia) stand out. These coins possess a pleasing aesthetic, making them attractive to some investors.

However, their average cost is higher compared to other investment coins. Furthermore, profit from selling such coins can only be made during periods of economic prosperity when their value significantly increases due to their collectible rarity.

These coins are not suitable "for a rainy day," as under conditions of economic turmoil, they are sold exclusively at their metal value, just like other investment coins.

- Aesthetically pleasing

- Average cost is higher

- Profit from sale only possible during economic prosperity (due to collectible rarity)

- Not suitable "for a rainy day" (sold at metal value)

- Have a wide spread

Expert's Choice: Australian Kangaroo – The Optimal Solution

According to Dmitry Kalinichenko, the golden Australian Kangaroo is the best coin for investment. Its cost is close to that of the most affordable investment coin – the Canadian Maple Leaf.

The Kangaroo surpasses the Maple Leaf in minting quality and has fewer subtle manufacturing defects. Its annually changing design also allows for playing on rarity premiums.

A special plastic capsule, in which the coin is sold, helps preserve the golden Australian Kangaroo in perfect condition, highlighting its investment value and quality.