Your Golden Shield: Investment Coins That Truly Deliver

Look beyond the daily fluctuations of stock market charts. Discover how investment coins can serve as your personal golden hedge – exempt from VAT and refreshingly free of typical financial complexities. Insider insights from a seasoned expert.

Your Golden Shield: Investment Coins That Actually Work

Listen up. If you're looking for a place to park your money so it doesn't burn out, but quietly multiplies, forget about hyped tokens and shady funds. There's a topic, proven over centuries – investment coins. These aren't for boring collectors with magnifying glasses; they're for you, who wants a real asset. No fluff, just facts.

Investment Coins: What They Are and Why They're Not 'Just Pretty Tokens'

Imagine this: it's a gold or silver bar, but in a convenient and, importantly, tax-advantageous form. The Central Bank mints them not for beauty, but for investment. The main thing here is the metal's fineness and its weight. No fancy designs, no microscopic mintages like commemorative coins that collectors will later overpay for. It's simple: gold is gold. Or silver.

That's why their price is always as close as possible to the market value of the metal itself. This isn't a painting whose price depends on the critics' mood. This is a pure, tangible asset.

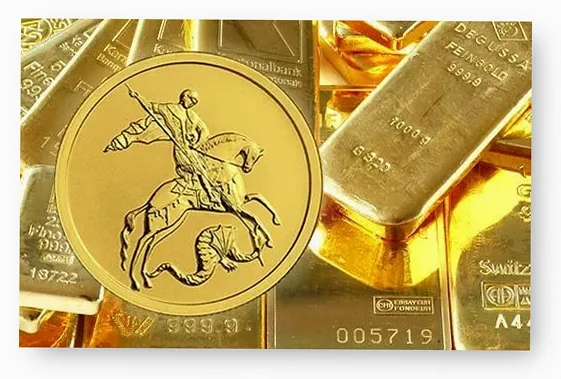

The 'Saint George the Victorious': Your Ticket to the Gold Reserve

Speaking of our coins, the undisputed hit is the 'Saint George the Victorious'. It comes in gold (50 rubles face value, 7.78 grams of pure gold) and silver (3 rubles face value). This is our own, Russian, clear, and liquid instrument.

Want real numbers? Here's an example. In 2013, a gold 'Saint George' cost approximately 19,987 rubles. In 2018, its price exceeded 29,600 rubles. That's, for a moment, almost 50% growth in five years. And this isn't the 'ceiling', but just an illustration of movement. The face value remained 50 rubles, but who cares about that? We're not chasing face value.

These quotes change daily following world metal prices. The Central Bank constantly updates its selling prices. You can check – all information is public.

How to buy without losing out?

It's simple: you need a passport. Coins are sold in banks (Sberbank is the largest player), but there are also specialized dealers. Check availability before you go. And yes, some banks also buy them back. But there's one important point here.

Also: all coins usually come in special transparent capsules. Do not remove them! Any scratch, fingerprint, or even slight wear will reduce the price when you sell them back. The capsule is protection for your investments.

Conclusion: Gold is always gold

Investment coins are not just metal. They are a time-tested way to preserve and grow capital, especially when things are turbulent. They are liquid, understandable, and exempt from VAT. Invest in what has real value, not in ephemeral promises. And remember: gold is always valuable in a crisis.

By the way, our catalog always features verified investment gold and silver coins, including the 'George the Victorious' itself. Come in, browse, choose.